modified business tax nevada instructions

TurboTax Offers Industry-Specific Tax Solutions So You Uncover Every Business Deduction. Modified Business Tax NRS 463370 Gaming License.

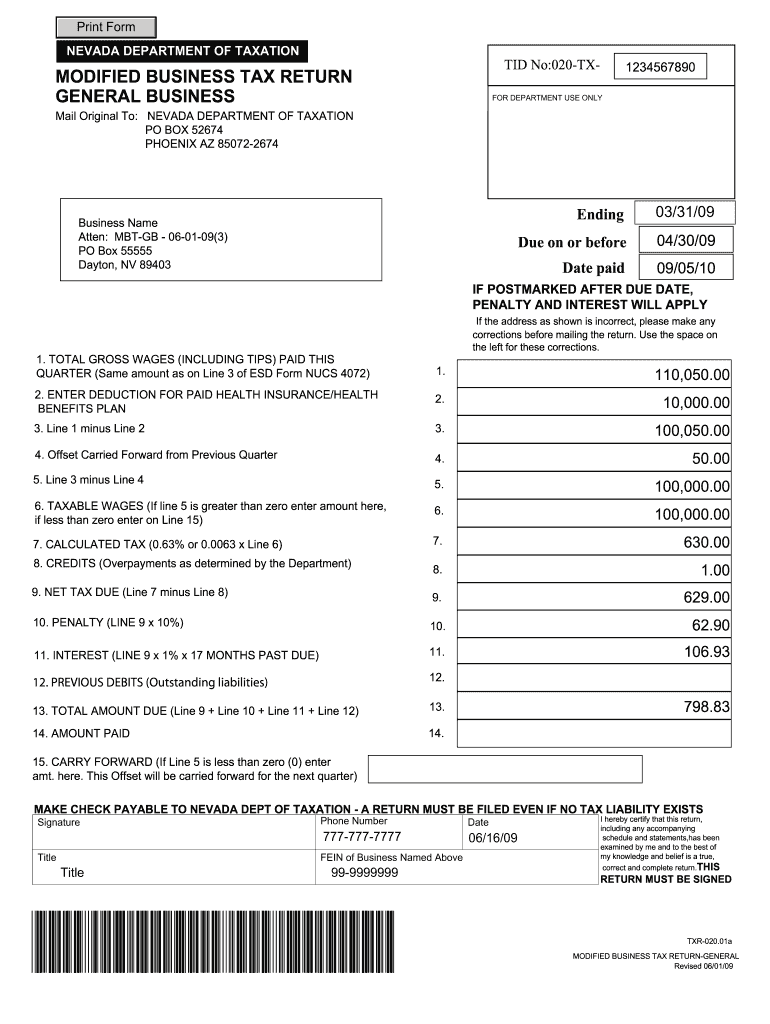

Nevada Modified Business Tax Return Fill Online Printable Fillable Blank Pdffiller

For Modified Business Tax you should also contact the Department of Employment Training and Rehabilitations Employment Security Division at 775 684-6300.

. Overview of Modified Business Tax. Understanding the Nevada Modified Business Return and Tax Form. Ad Download Or Email NV TID 020-TX More Fillable Forms Register and Subscribe Now.

NEVADA DEPARTMENT OF TAXATION Title Phone Number Mail Original To. Close Account Form Request. As in most states ever employer subject t the states unemployment compensation law is subject to a Modified.

Right click on the form icon then select SAVE TARGET. Modified Business Tax. The modified business tax covers total gross wages less employee health care benefits paid by the employer.

Get the tax answers you need. Decide on what kind of. The modified business tax MBT is considered a payroll tax based on the amount of wages paid out in a quarter.

Built For Small Business. If you are using Chrome Firefox or Safari do NOT open tax forms directly from your browser. The tips below can help you fill out Nevada Modified Business Tax quickly and easily.

Any employer who is required to pay a contribution to the Department of. Built For Small Business. Total gross wages are the total amount of all gross wages and.

Enter your Nevada Tax Pre-Authorization Code. Click here to schedule an appointment. Every employer who is subject to Nevada Unemployment Compensation Law NRS 612 is also subject to the Modified Business Tax on.

Enter Previous Owners ESD Account Number. Ad Download Or Email NV TID 020-TX More Fillable Forms Register and Subscribe Now. Get Every Credit And Deduction Your Small Business Deserves.

We have the experience and knowledge to help you with whatever questions you have. MODIFIED BUSINESS TAX RETURN 1. A Nevada Employer is defined as per NRS 363B030.

Ad You Can Drop Off Your Taxes And Still Get Personalized Tax Expertise From Block Advisors. Ask the Advisor Workshops. Follow the step-by-step instructions below to eSign your nevada modified business tax.

Ad You Can Drop Off Your Taxes And Still Get Personalized Tax Expertise From Block Advisors. Clark County Tax Rate Increase - Effective January 1 2020. Include a copy of the original return 2.

Write the word AMENDED in black ink in the upper right-hand corner of the return. Complete the necessary fields. A partial abatement of the business tax during the initial period of operation is available.

Nevada Modified Business Tax Rate. Get Every Credit And Deduction Your Small Business Deserves. Ad Talk to a 1-800Accountant Small Business Tax expert.

Open the document in the full-fledged online editor by hitting Get form. Enter Your Previous Nevada SalesUse Tax Permit Number if applicable. Select the document you want to sign and click Upload.

18 Signatures must be that of a responsible party I declare under. Signature Date 1 to 10 11 to 15. Nevada Revised Statute 363B120 provides an abatement of the Modified Business Tax for qualifying.

INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - FINANCIAL BUSINESSES ONLY General Businesses need to use the form developed specifically for them TXR-02005 Line 1. Line-through the original figures in black ink. Ad Keep Every Dollar You Deserve When You File Business Taxes w TurboTax Self-Employed.

Modified Business Tax Return Form Nevada Fill Online Printable Fillable Blank Pdffiller

Nv Dot Tid 020 Tx 2016 2022 Fill Out Tax Template Online Us Legal Forms

Nevada Modified Business Tax 2020 2022 Fill And Sign Printable Template Online Us Legal Forms